As the Fed keeps trying to find the right dosage level for the economy’s case of “inflation-itis,” the equity markets continued to ail during the second quarter, declining through the period on news of higher readings for the CPI and worries about how businesses will fare if the much-feared recession actually materializes. Read on for our summary and commentary on the main economic and financial trends during Q2 2022.

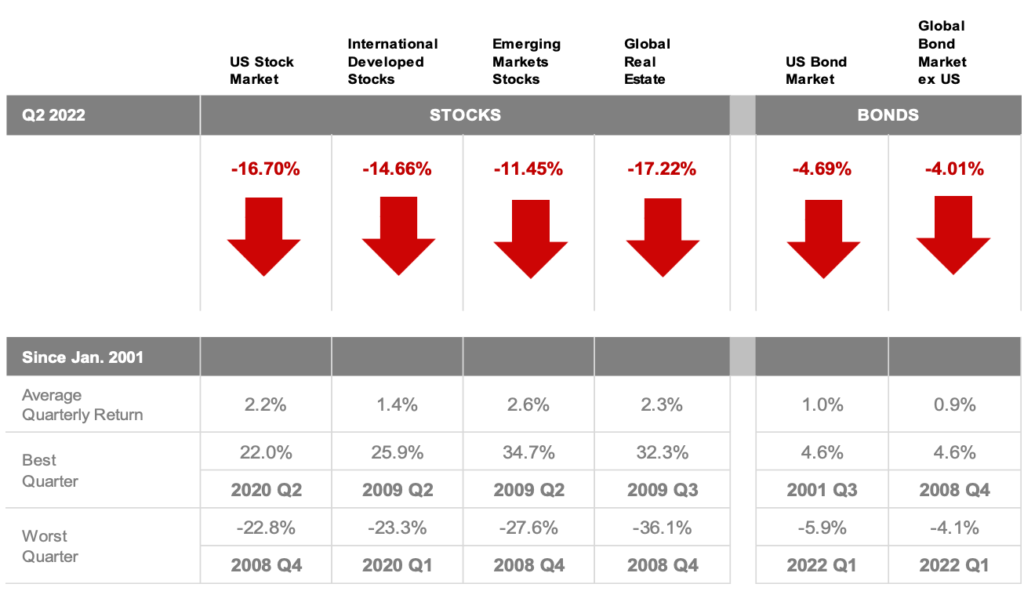

UUS Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net dividends]), Emerging Markets (MSCI Emerging Markets Index [net dividends]), Global Real Estate (S&P Global REIT Index [net dividends]), US Bond Market (Bloomberg US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Global Aggregate ex-USD Bond Index [hedged to USD]). S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global.

Still Waiting for Some Good News

The principal damper on equity markets during the period continued to be stubbornly high inflation; the steepest drops in share prices came with the announcement of unfavorable readings in consumer and producer prices, as both U.S. and foreign equity markets continued to struggle in the 2nd quarter. In the U.S., the broad Russell 3000 index fell 16.70% and the S&P 500 16.10%. Developed foreign equities (MSCI World ex-US) declined 14.66% for the quarter, and the MSCI Emerging Markets Index fell 11.45%. Interest rate and inflation worries likewise continued to impact bonds: the Bloomberg Aggregate Bond Index dropped by 4.69%.

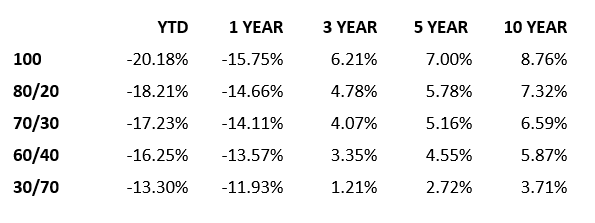

Indices used for hypothetical portfolios returns are the MSCI ACWI for equities and the BBgBarc US Agg Bond for fixed income. All data derived from Morningstar Office. Past performance is no guarantee of future returns.

Rate Hikes Here, Rate Hikes There

As it was during Q1, the main story remains inflationary pressures and worldwide efforts to rein these in without damaging economic growth, producing the greatly desired “soft landing.” It is a perilous balancing act, and financial markets remain on edge as central banks in the US and abroad play this theme out. At their June meeting, the Federal Open Market Committee increased the federal funds’ target rate range by an aggressive 75 basis points (0.75%) to 1.50%–1.75%—the first hike of this size since November 1994. The Fed commented that it “is strongly committed to returning inflation to its 2.0% objective,” a clear signal that more rate hikes are expected. Across the globe, other rate increases occurred, including surprise moves by both the U.K. and Switzerland.

Higher Yields on Treasury Bonds

Yields on the 10-year Treasury rose 65 basis points, ending the quarter at 2.97% (when bond yields rise, bond prices fall). Most bond market observers note that at approximately 3%, the 10-year Treasury is already trading near the targeted year-end expectations of the Fed, which may signal that the rate adjustment in bonds is mostly complete. Of course, this can change, but with growth slowing, bonds are once again gaining attention and fund inflows as investors move out of riskier assets and toward the perceived safe haven of bonds.

Guns, Grain, and Gas

As the larger war in Ukraine enters its fifth month, the resulting disruption and uncertainty continue to pressure many commodities. Crude oil prices increased nearly 5% in the second quarter, finishing at $105.82 per barrel (though gasoline prices began declining in the U.S. toward the end of June). Natural gas prices ended the quarter just below $6 per million BTU, up nearly 40% for 2022, to date. Grain disruptions due to the invasion are creating both price increases and shortages in developing countries. The price of gold, although benefiting from inflation, has been held back by a strong dollar and decreased by roughly 7%, ending the quarter at $1,808.00 per ounce.

Whither the Economy?

Economic data offers a mixed bag. On the one hand, job growth in the U.S. remains robust, with a 3-month average of 375,000 new jobs monthly. But that has slowed from a 12-month average of 561,000, and the numbers indicate a remaining gap of 524,000 jobs lost since February 2020 (pre-pandemic). Forward-looking economic indicators are less optimistic, contributing to rising worries of a recession on the horizon. The Conference Board LEI index has fallen for the past several months, consumer confidence is ebbing, and the closely watched difference between 10-year and 2-year yields (the 10-2 spread) is flirting with inversion, signaling concerns over future economic growth (when long-term yields are lower than short-term yields—an inverted yield curve—it is a signal that bond investors expect longer-term yields to decline, which is typical during recessions). Not surprisingly, analysts are closely watching corporate earnings for clues about the overall health of various sectors of the economy.

And Don’t Forget the Virus

COVID remains a factor as well as the pandemic enters its third year. Rising cases in Hong Kong and China are again stirring fears over societal and economic shutdowns, and in the U.S., the highly contagious ba.5 variant is spreading. The good news is that health impacts seem to be far less serious than with previous waves, but the continued presence of COVID around the globe cannot be ignored.

Catching the Next Wave?

For many investors, things may seem a bit bleak at present, and there are plenty of reasons for concern. On the other hand, the markets have proven remarkably resilient over the years—and also virtually impossible to predict. Studies have shown that no one can anticipate the next major market updraft—or downdraft—with better than random accuracy. For most investors, then, the best results will be achieved by “sticking to the plan,” maintaining broad diversification, and rebalancing when appropriate. If you would like to review your current plan or you have other questions, JFS Wealth Advisors would love to hear from you.