We’re all feeling it. Financial markets around the world had a difficult third quarter, as pressures from inflation, rising interest rates, and geopolitical turmoil continued to weigh heavily on sentiment. The broad US stock market declined 4.5%, small US companies as measured by the Russell 2000 decreased 2.5%, while international developed markets fell 9.2%, and emerging markets were down 11.6%. The rate environment similarly held back bond returns, with the Bloomberg US Aggregate Index falling 4.8%.

US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net dividends]), Emerging Markets (MSCI Emerging Markets Index [net dividends]), Global Real Estate (S&P Global REIT Index [net dividends]), US Bond Market (Bloomberg US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Global Aggregate ex-USD Bond Index [hedged to USD]). S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global.

The 10-year US Treasury, which began the year at 1.8%, ended the quarter up 0.8% to yield 3.8%, continuing its dramatic 2022 rise. In the face of stubborn inflation, the Federal Reserve has raised its target Fed Funds rate five times since March, most recently 0.75% in September. Expectations for their November and December meetings are still for rate hikes at one or both meetings. When the cycle pauses depends on both inflation and labor market data, with the Fed looking for clear signs that both are cooling.

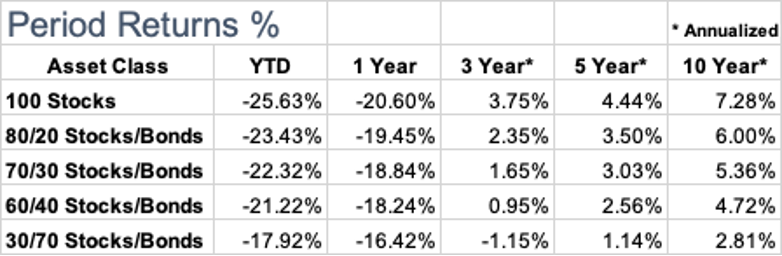

Indices used for hypothetical portfolios returns are the MSCI ACWI for equities and the BBgBarc US Agg Bond for fixed income. All data derived from Morningstar Office. Past performance is no guarantee of future returns.

Economic data is sending mixed signals.

The most recent labor report showed 263,000 new jobs created in September, but that is down significantly from the year-to-date monthly average of 420,000. Unemployment is at a low 3.5%, yet jobless claims are beginning to increase and the number of open jobs per job seeker is falling.

Two important leading indicators, the ISM business surveys on manufacturing and services, while in positive territory, are both treading water from mid-summer, and down since the beginning of the year. New factory orders are down as well. Yet, consumer confidence increased in September as falling gas prices put more money into consumer pockets. Gross domestic product (GDP) in the US has faltered in 2022, but estimates are for low growth (Goldman predicts 1.9% year-over-year) as 2022 wraps up.

This data tug-of-war is a result of a strong post-pandemic US economic recovery running headlong into a Federal Reserve determined to slow inflation which was launched by stimulative policies kept in place for too long. It has been over 40 years since the US endured this kind of inflation (8.3% CPI over the last 12 months) and Fed Chair Jerome Powell is determined not to repeat the mistake of the Fed in that period, which eased off the interest rate brake too soon, leading to an infamous “double-dip” recession. Powell has indicated that “pain” is going to continue until they believe inflation fever has broken.

It’s not all negative. The positive aspect of all of this is that markets believe inflation will drop. The bond market is signaling 2.3% looking ahead five years. This means that high-quality bonds, now sporting yields of 4% or above, are positioned to do far better in the years ahead, and stocks, while still in bear market territory, are at attractive valuations when compared to long-term averages. In other words, the stage is set for brighter days ahead.

In the face of declining global economic output, crude oil ended the quarter just below $80 per barrel, but, in a slap to the US, on October 5 OPEC+ announced production decreases of 2 million barrels/day to increase the price, and prices at once began to climb. This will add pressure to economies and job markets, and, in a counter-intuitive manner, may speed up the processes needed to slow growth, labor markets, and inflation to the point where the Fed pauses. Another large part of inflation has been the red-hot housing market, but with 30-year mortgage rates now at an average of 6.7%, that too is slowing rapidly.

Rising rates in the US have led to the dollar strengthening against all major currencies. Gold, which typically moves opposite to the dollar, declined by $ 7.55 for the quarter, ending at $1,670.50 per ounce.

At JFS, we understand the complexities of the economy and how it impacts our clients’ financial wellness. That’s why we proactively plan for the ups and downs of the global market and the economy and employ diversification strategies across our clients’ portfolios. If you’re feeling uneasy about the current landscape, reach out. Let’s talk about it and stress test your long-term plan so that you can move forward with confidence.