The Fed delivered this week as expected – a one-half-of-one percent (50 basis point) hike in short term interest rates, and a plan for allowing their $ 9 trillion bond portfolio to begin to shrink. The benchmark Fed funds rate is now targeted for a range between 0.75% and 1.0%. Beginning in June bonds will be allowed to mature and “roll-off” the Fed’s balance sheet, with no new purchases to replace those holdings. The numbers are large – $47.5 billion per month through August increasing to $95 billion each month thereafter.

Financial markets initially greeted this significant but measured action positively – stocks rallied, and interest rates eased. But worries resurfaced quickly, with stocks giving back their gains and the bellwether 10-year Treasury bond yield climbing back through 3%. It has been over twenty years since a Fed raised rates by 50 bps, and adjusting to the painful inflation landscape is a new experience for many market participants.

Markets are telling us there is still a “lot of wood to chop” with respect to getting rates to a normalized level. While the Fed is seeking to engineer a “soft landing” for the economy, the history of doing so successfully is one of more crash landings than soft. The ideal outcome is one in which the Fed can raise rates just enough to bring down inflation while not pushing the economy into a prolonged recession.

There are two key factors in our favor regarding the current economy: Full employment with job demand still going strong. Today’s release of 428,000 new jobs created in April exceeded estimates. In addition, consumers are generally well-padded thanks to a buildup of cash reserves accumulated during the pandemic. In other words, an economy that is strong enough to weather Fed-induced headwinds.

So what can we expect from here?

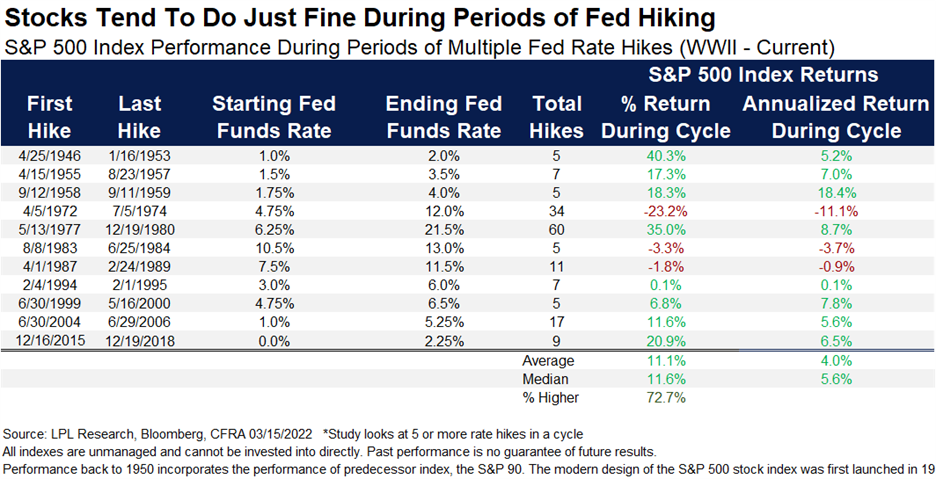

It is a fool’s errand to make precise predictions, but we can observe that historically, rate hikes do not spell all gloom. Per the chart below, the median annualized return of the S&P 500 throughout hiking cycles has been 5.6%.

Of course, each cycle is unique, and to be fair, today’s situation with inflation pressures coming from both a demand/labor shortage perspective, as well as supply shocks due to Covid and the Russian invasion of Ukraine, more closely resembles some of the 1970 and 1980 periods when stocks struggled throughout the hiking process. But, as we have noted in previous communications this year, markets are forward-looking, and interest rates for the 10-year Treasury and mortgages have already climbed significantly. In other words, the economic brakes were being applied before the actual action from the Fed. Data continues to indicate inflation pressures easing and an economy beginning to come off a boil, which could mean much of the work is already underway.

Whether or not the Fed can engineer a “soft-landing” for the economy and markets remains to be seen. But from a portfolio perspective, the higher rates, while initially depressing bond prices, will be good for fixed income investors in the longer-run, and stock markets will (and already have) actively shift forecasts to benefit companies that can better navigate higher rates while maintaining profit margins. Traditionally that emphasis is to dividend-paying and a value orientation, styles that are prevalent in JFS portfolios.

Turbulence is part of investing. While never enjoyable, the declines in stock and bond prices in 2022 to-date are understandable and are part of the adjustment to a different economic landscape. The inevitable volatility sets the stage for future gains. Long-term financial plans eclipse short-term volatility, and history is clear of the benefits to keeping one’s eyes to the horizon rather than fretting over an immediate worry. Please contact your advisory team for questions specific to your situation, and as always, thank you for the continued confidence.