It’s been hard to turn down the noise so far in 2022. Even as the COVID waves ebb, other worries rush in – frozen supply chains, worker shortages, rising worldwide inflation pressures, and now geopolitical turmoil as Russian troops mass on Ukrainian borders… there scarcely seems a stable island in the storm.

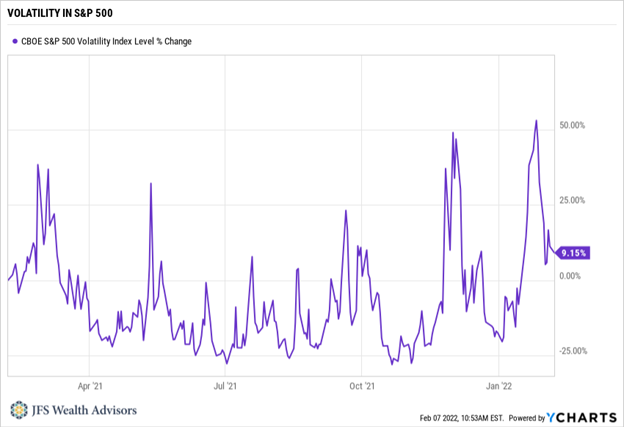

Stock volatility has risen to levels seen at the height of the original pandemic fears in 2020. And at the same time, a sea change is occurring in interest rate policy from the Federal Reserve as it tapers bond purchases – withdrawing liquidity from the system – and prepares to raise rates as the U.S. economy grows and unemployment shrinks. Lions and tigers and bears, oh my! The urge to react – to “do something” – is hard to avoid.

A helpful step in the face of uncertainty may be to ask yourself what you are, an investor or a trader? While both investing and trading are verbs and imply action of some sort, they are vastly different. Investopedia defines investing as “…the act of allocating resources, usually money, with the expectation of generating an income or profit,” and trading as “…implies active participation in the financial markets. Buying and selling securities to earn profits.”

Notice a difference? While both seek to grow a sum of money, how that goal is pursued is not at all the same. Patient “allocating of resources” vs. “buying and selling.” While trading is not necessarily bad, we at JFS are firm believers that investing – carefully allocating resources synchronized with financial, tax, and estate planning – is a far superior way to grow wealth over time.

Putting the 24/7 barrage of news into perspective is not easy, but the daily headlines are mostly germane to traders, not investors. We have often noted that our human characteristics conspire to work against us in successfully building wealth. A recent Wall Street Journal article by Jason Zweig notes our preoccupation with the change in our wealth rather than focusing on goal-driven targets that will position us for security and success. When we are obsessing over short-term swings, bad and scary potential outcomes naturally take precedence in our thinking. In other words, the downs of markets get our attention far more often and trigger the primitive fight or flight syndrome (SELL!), typically to our detriment.

Mr. Zweig goes further to issue a fascinating challenge: what were you worried about in your portfolio 10 years ago? The 2008 Global Financial Crisis was still fresh, and “low growth” was the new mantra. While real concerns seemed appropriate at the time, over the last 10 years, stocks as measured by the S&P have grown at a sizzling compounded rate of over 15% per year. Giving into fears that seemed oh-so-pressing at that time and running to bonds would have provided a compound return of 2.6% per year. And cash, which is a tempting siren call for stability of principal? The return of Vanguard’s Treasury Money Market was 0.55%. The price of avoiding fear may have dampened worries, but simultaneously assured being unable to participate in such positive stock market growth.

So, holding that in mind, let’s take a quick look at some of today’s factors – both positive and negative – that are at play.

- Stock markets have been volatile. Recent weeks have seen large swings – at one point in January, the tech-heavy Nasdaq was down nearly 15% for the year, rebounded by 7%, and at this writing is down 9.5% since 12/31. Other indices have similar experiences – the broader measure of the S&P 500 had declined approximately 5% year-to-date.

- Yet, corporate earnings continue to positively surprise. Nearly 80% of companies that have reported so far have exceeded expectations. While the high-octane growth stocks have seen valuations pared back, many CEOs are optimistic. Levi Strauss’ Chief Executive recently noted, “inflation is partially psychological…and we’re watching the consumer like a hawk. But right now, every signal that we’re seeing is positive. And we know that we’ve been successful in getting pricing passed through over the last six months.” And Dow’s CEO commented, “I’m not pessimistic about inflation killing demand. Honestly, inflation has always been a positive for our business. And over the last 30 years, when the Fed raises interest rates, that typically tends to drive outperformance in our sector versus the other sectors.”

- U.S. GDP grew in the 4th quarter at a 6.9% annual rate, and rose 5.5% for the full year of 2021, the fastest growth since 1984, Reagan’s first term. But inventory restocking had a lot to do with it. Growth is likely to gradually slow back toward a longer-term trend of 2% – 2.5%.

- Jobs growth is positive – payrolls increased by 467,000 in January, and November/December job creation was revised upwards by over 700,000. Labor force participation has begun to creep upwards – currently, it is at 62.2%, up from 61.9% in December. All signs point to workers beginning to return. Some 8.8 million people reported being unable to work in January due to COVID – either being out sick or caring for someone who was. As Omicron subsides, those workers become available to join the workforce.

- In the face of this data, the Federal Reserve is wrapping up its open market bond purchases and making clear that rate hikes are imminent. The prospect of interest rate hikes has spooked many. Yet it’s important to put likely rate hikes in perspective to previous cycles. Four increases of .25% each would take the upper end of the Fed Funds rate to 1.25%, still well below pre-pandemic levels. And looking back to 1973, the average level of hikes in a Fed tightening cycle was 3%, with a median of 2.5%. In other words, there is still a very long way to go before any rate hikes are extraordinary.

- The latest data shows that average hourly wages increased by 4.7% year-over-year, with the largest of those increases concentrated at the lower end of the wage spectrum. Unambiguously positive, but inflation has eroded most if not all of those gains. There are encouraging signs that inflation has peaked as supply shortages begin to ease, but at the same time, higher wages will keep inflation pressures alive.

- Roughly 84% of jobs lost in the pandemic have returned, and unemployment is down to just over 4%, but shrinkage in the labor pool continues to pressure employers. While more are returning to work, it is increasingly apparent that a lower labor participation rate is here to stay. Immigration could relieve some of that pressure but remains a hot-button topic.

As you can see, the perennial tug of war between optimists and pessimists continues at a furious pace. But this is nothing new. History tells us that when it comes to building wealth, optimism in financial markets is rewarded. While being incautious and chasing risk for the highest possible returns is a recipe for disappointment and broken plans, thoughtful and patient asset allocation driven by planning goals is a recipe for success. Being deterred by the always-present litany of worries at any moment impedes the long-term growth of wealth to meet planning and estate goals.

Please reach out to your advisory team with any questions or concerns. Thank you for your continued confidence.