Merriam-Webster recently named “gaslighting” – misleading or manipulating behavior – as their 2022 word of the year. Lookups for the word on their website increased a whopping 1,740% from the year before. They say that they are not certain what drove the jump, but it seems clear that the public was interested in things that may not be as they appear. Perhaps that is a commentary on the broader world in which we live these days – frequently cynical, often deceptive, always surprising.

As we thought about the world of markets and investing, what struck us as appropriate for a 2022 financial phrase of the year (although certainly not as hip as gaslighting) was “repricing”. The same Merriam-Webster provides an example of its use as “to find out the price of something” again. Pretty apropos – wouldn’t you think, especially if you have been a crypto fan this year? Your holdings have been “repriced” – in some cases that’s a polite euphemism for zero. Perhaps an extreme example, but, whether speculative or otherwise, most major financial assets underwent similar moves this year – finding a new price (mostly lower) to reflect a world landscape dramatically altered from just a short 11 months ago.

What drove 2022 to be such a difficult year across so many asset classes – stocks, bonds, housing, crypto?

As we wrote earlier this year, a confluence of events and situations that led to a near-perfect storm for most major financial markets. Let’s look at the main influences leading to the repricing, what those were, where they are now, and where they might be going.

Financial markets run on interest rates like our bodies run on water – they are essential for functioning. And 2022 has seen one of the most dramatic changes in interest rates in 50 years. Not since “The Great Inflation” of the 1970s and the subsequent interest rate moves by then-Fed Chair Paul Volcker have we seen such a sea change in interest rate policy. Seven times beginning in March, and still counting when looking ahead, the Fed has raised its benchmark lending rate – the fastest pace on record. Not surprisingly, the impact has been substantial.

The reason for the rate hikes has been inflation. The origins of 2022’s stubborn inflation problem are varied, but the blame can be laid largely at the feet of stimulative monetary policy leading up to and during the Covid pandemic, supply chain and labor market disruptions from the pandemic, all then spectacularly juiced in February of this year when Russian tanks and troops rolled into Ukraine, leading to spiking oil, gas, and grain prices. It has been, indeed, a Cat 5 event.

Putting aside the debate over laying blame for spiking inflation and whether or not the government and the Fed have handled the situation well, rising rates have led to markdowns in prices for bonds, stocks and housing. As rates rise, bond prices fall until equilibrium prices are established. For stocks, future earnings are negatively affected because they are now discounted at a higher interest rate, making those earnings worth less in today’s dollars. Thus, prices have to fall to reach realistic price/earnings multiples (P/E). And in housing, one simply needs to look at mortgage rates to understand why the pace of sales has drastically slowed. With 30-year mortgages now costing over 6%, affordability for many homes has been put out of reach.

So, we are poised to enter 2023 with many events in motion, not all of which are aligned, and some are even contradictory. To wit: A strong job market and low unemployment have led to climbing wages. But too much of a good thing risks wage-price inflation, which then necessitates more rate hikes to control. And while a solid 263,000 new jobs were created in November, most manufacturing and forward-looking indicators are suggesting a future slowdown and perhaps recession. Supply chains are healing, inventories reducing, and consumption patterns shifting from the pandemic model of remote order goods to services, but the concurrent labor shortages are reinforcing the wage pressure and inflation. In the topsy-turvy logic of interest rates and markets, the good news is bad, and vice versa. Ironically, markets are looking for signs of slowing hiring and consumption in the hopes this will lead the Fed to dial back their pace of rate hikes.

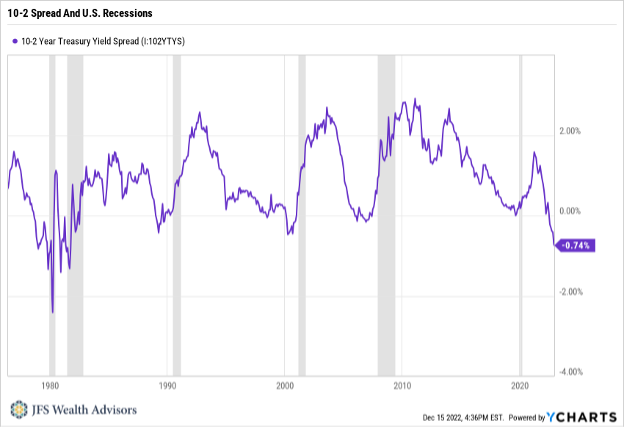

The clear and present risk now is a recession – an economy slowed by the above culmination of factors to the point where domestic production (GDP) turns negative. One of the most reliable recession indicators – the yield curve difference between 10- and 2-year treasuries known as the 10-2 spread – is flashing red. Note the chart below where the grey bars indicate recessions. The relationship between a negative spread (value below zero) and a later recession is evident.

For illustrative purposes only. Past performance is no guarantee of future returns.

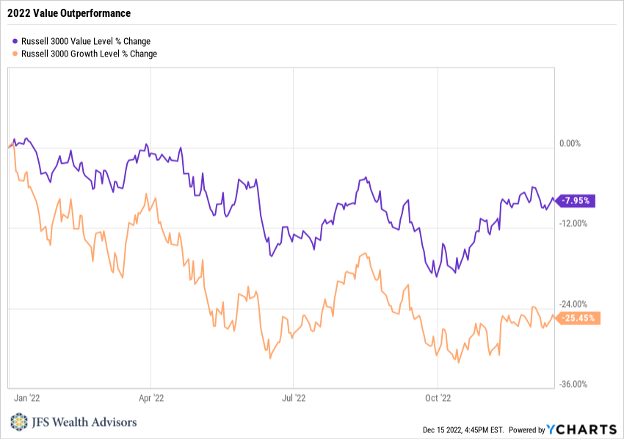

As always, please contact your team for specifics to your individual investment portfolio information but let’s talk briefly about portfolios. In the general term situation, JFS portfolios have fared well in a difficult environment – limiting price declines compared to broad indices, and thus keeping more capital to work when the rebound occurs. On the equity side, the value tilt preferred in most JFS portfolio models has been a significant benefit. See the chart below of large value and large growth – the large gap reflecting value outperformance is dramatic. And while a future crystal ball is always cloudy, the current environment with recessionary fears and interest rate pressures should continue to benefit a value orientation.

For illustrative purposes only. Past performance is no guarantee of future returns.

And on the fixed income (bond) side, while prices have suffered, JFS holdings have generally been of shorter duration than benchmarks, leading to a better return outcome. And the bright silver lining of short-term pain is that yields are once again attractive and suggest far better returns in the future for the asset class. As one of our industry associates put it – “bonds are self-healing” In other words, the higher yields now being realized will act to offset the temporary price declines. Yields on high-quality bonds today are generally well above 4%, and as inflation returns to its longer-term historical levels of 2% – 3%, attractive “real yields” – returns above inflation – are once again likely. The current yield curve is resulting in unique opportunities for certain short-term securities to shine. We urge you to contact your advisory team to discuss any cash or short-term needs you have and ensure your yields are being maximized.

There is much, much more that could be covered. But if we have kept you reading this far, we will choose to now stop and assure you that in the year ahead we will continue to touch on timely topics of importance and do our best to keep you informed without bogging down in details. While we live in the world of daily market information, we know that most of you do not, and thus we look to touch on only high points. Your advisory team is your prime source of information for your financial plan and portfolios – please reach out to them with follow-up questions.

As is so often the case, as 2022 draws to a close, all eyes remain on the Fed. In their meeting that ended December 14, they raised the Fed Funds rate by 0.5%, their 7th hike in 2022. The benchmark target is now 4.25% – 4.50%, the highest level in 15 years. While the 2023 path is not known, Chair Jerome Powell and his colleagues have made clear additional hikes are likely until they are clearly convinced the labor market is loosening and the inflation bogeyman is back under the bed. So, while the pace of hikes is easing, there are more to come, and the fears of an economic recession, as a result, are rising. As we write this, stock markets are reacting negatively to the perceived continued pressure on rates. Should a recession occur, a typical response from corporate earnings is a 15% decline. In that case, to maintain a historical valuation on the S&P 500, levels could fall to 3200 from the current value of 3890. So, entering 2023 could be bumpy. We continue to believe that a conservative, well-balanced portfolio approach remains the best vehicle for navigating these choppy waters.

No matter the direction of interest rates or financial markets, please know that the primary goal of your JFS team is to design and implement financial plans and investment solutions to help you succeed. On behalf of all my colleagues, thank you. And best wishes for the Holidays and a Happy and Healthy New Year.