Depending on your point of view, living in “interesting times” can be either a blessing or a curse. Leaving aside the truly horrific human costs of the war in Ukraine, the financial markets have reacted strongly to the myriad uncertainties surrounding current global events. Here’s a recap of the most important matters impacting markets and the economy for the first quarter of 2022.

Global Markets, Global Troubles

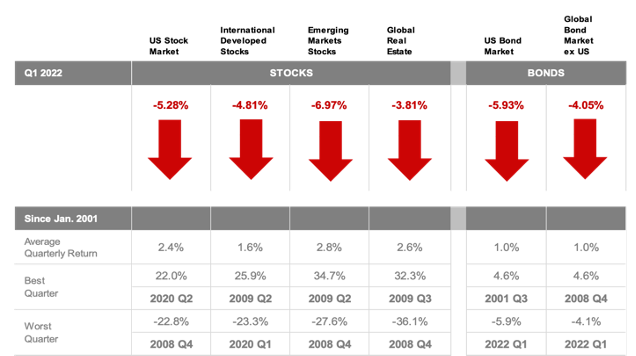

Already facing headwinds because of worries over interest rates and inflation, US and foreign equity markets went into a deeper slide following the Russian invasion of Ukraine on February 24. Domestically, the Russell 3000 index fell 5.3%, accompanied by the S&P 500 (down 4.95%). Equities in developed foreign markets, as represented by the MSCI World Index (ex-US) declined 4.81% for the quarter, and the MSCI Emerging Markets Index also fell 6.97%. Fixed income markets felt the pain also, as interest rate pressures pushed the Bloomberg Aggregate Bond Index down by 5.93%.

The Fed: “No More Mr. Nice Guy”

Early in the quarter, the US Federal Reserve signaled an aggressive posture toward inflation. On March 16 the Federal Open Market Committee raised the federal funds target rate to 0.25%–0.50%, but more importantly indicated more hikes to follow. The Committee anticipates up to six rate hikes over the next year and has more recently signaled some of those could occur in one-half percent (50 basis points) increments. If that happens, it would mark the most aggressive round of interest rate hikes since 1994. At the same time, the Fed has begun selling off portions of its holdings in US Treasury securities and mortgage-backed bonds, further reducing the money supply in an effort to put the brakes on inflation.

Price Blowback

In reaction to Fed actions and other factors, yields on the 10-year US Treasury bond rose nearly 80 basis points (0.8%), ending the quarter at 2.3% (when bond yields rise, bond prices fall), a level last seen in May 2019, well before COVID-19. Adding to the upward pressure on prices, crude oil skyrocketed following the invasion of Ukraine and the resulting Western restrictions on Russian oil and gas imports, rising over 30% in the first quarter to finish at $100.94 per barrel. The price of gold, a classic inflation hedge, saw a slight increase, ending the quarter at $1,941.50.

Meanwhile, Back at the Economy

Despite all the above, there is a glimmer of good news: US economic data, while indicating a slowing economy, remained positive in the quarter. ISM manufacturing data (Purchasing Manager’s Index, or PMI) grew for the 22nd consecutive month, as did service sector activity. Unemployment sits at 3.62%, down to a level seen only 5 other times since 1969. The job market is a seeker’s dream, with over 11 million openings and roughly 6 million unemployed, a stunning 5 million–worker gap, which makes it a fortunate time to be job-hunting. This condition is also, of course, creating upward pressure on wages—and inflation. More people are returning to work as pandemic effects wane, which should alleviate some of the pressure. But speaking of inflation, the Fed’s favorite measure of inflation, the core PCE deflator, increased 5.4% over the last 12 months: well above the stated 2% target. Of course, it’s not as though evidence of inflation is lacking: just fill up the car or shop for groceries, and you’ll easily notice. The Fed continues to express the opinion that some of these pressures should ease, but given the current geopolitical turmoil and continued demand for products in short supply, that is probably not in the cards, any time soon.

Pandemic: To Be Continued?

In the US, COVID-19 cases have declined dramatically, but they are rising in China and Europe. As much as we may wish it banished, COVID-19 remains with us and may well impact the US again over the summer and into fall.

Investing for the Long Run

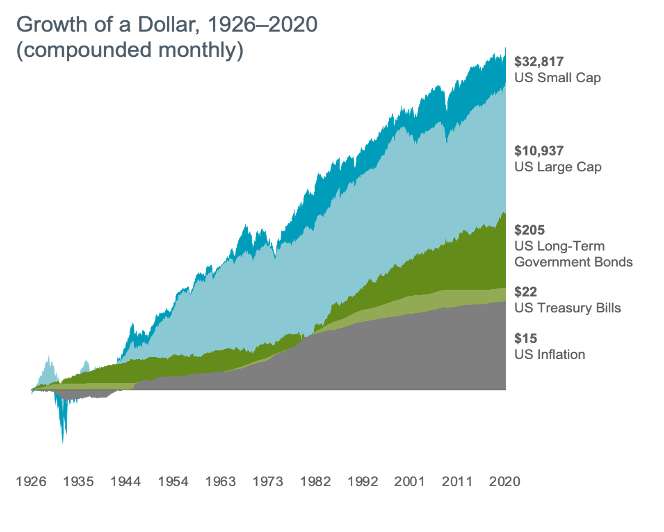

This may seem like a volatile time in the market, but keep in mind, that the financial markets have long rewarded long-term investors. People expect a positive return on the capital they supply, and historically, the equity and bond markets have provided growth of wealth that has more than offset inflation as indicated in the chart below.

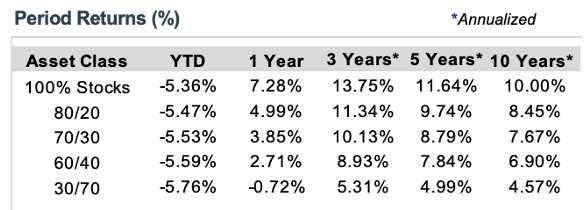

Top Chart: US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net div.]), Emerging Markets (MSCI Emerging Markets Index [net div.]), Global Real Estate (S&P Global REIT Index [net div.]), US Bond Market (Bloomberg Barclays US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Barclays Global Aggregate ex-USD Bond Index [hedged to USD]). Middle Chart: Indices used for hypothetical portfolios returns are the MSCI ACWI for equities and the BBgBarc US Agg Bond for fixed income. All data derived from Morningstar Office. Past performance is no guarantee of future returns. Bottom Chart: In USD. US Small Cap is the CRSP 6–10 Index. US Large Cap is the S&P 500 Index. US Long-Term Government Bonds is the IA SBBI US LT Govt TR USD. US Treasury Bills is the IA SBBI US 30 Day TBill TR USD. US Inflation is measured as changes in the US Consumer Price Index. CRSP data is provided by the Center for Research in Security Prices, University of Chicago. S&P data © 2021 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. US Long-term government bonds and Treasury bills data provided by Ibbotson Associates via Morningstar Direct. US Consumer Price Index data is provided by the US Department of Labor Bureau of Labor Statistics. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is no guarantee of future results.