The first quarter of 2023 saw both stocks and bonds continue the positive momentum. But the period was not without drama, as banks across the globe, with balance sheets negatively impacted by the sharp rise in interest rates over the past 12 months, drew an unwanted spotlight.

US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net dividends]), Emerging Markets (MSCI Emerging Markets Index [net dividends]), Global Real Estate (S&P Global REIT Index [net dividends]), US Bond Market (Bloomberg US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Global Aggregate ex-USD Bond Index [hedged to USD]). S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global.

While the stress appears to be easing, two US banks failed in March as depositors withdrew assets at a furious pace, and in Europe, the venerable Credit Suisse was taken over by UBS. For the quarter, the broad U.S. stock market gained 7.2%, and small US companies, as measured by the Russell 2000, climbed 2.3%. Aided by a weaker dollar, international developed markets rose 8.0%, and emerging markets were up 1.4%. Expectations that interest rate pressures will ease benefited bonds, with the Bloomberg US Aggregate Index gaining 2.9%.

Most U.S. economic data continue to point toward a slowing economy, and increasing credit tightness stemming from bank caution will likely reduce lending, which could hasten a move toward recession. Manufacturing data through March posted its fifth month of decline, falling 1.4% for the month, with new orders leading the way, down 2.7%.

Mortgage rates above 6% continue to pressure single-family housing, with pending home sales declining at a sharp 21.1% year-over-year.

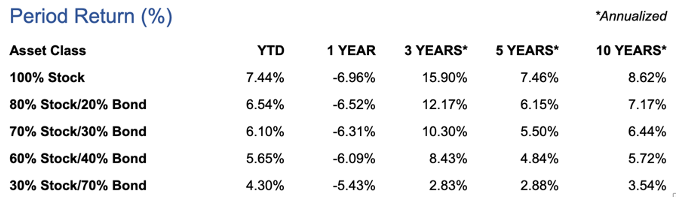

Indices used for hypothetical portfolios returns are the MSCI ACWI for equities and the BBgBarc US Agg Bond for fixed income. All data derived from Morningstar Office. Past performance is no guarantee of future returns.

Multi-family housing has seen strength as buying a home is unaffordable for many, but even there, signs of excess capacity are beginning to show. Somewhat surprisingly, in the face of price pressures, consumer spending has risen so far in 2023, but excess savings are depleting. With student loan payments set to restart soon, economists believe spending will also cool.

On the business front, capital spending has slowed, profit margins have shrunk, and earnings estimates are being cut. By almost any measure, whether an actual recession ensues or not, the pace of growth has cooled.

Overseas, Europe and other developed countries have shown economic resilience, leading to market strengthening. China continues reopening after lifting Covid restrictions, leading to optimism for continued emerging market growth.

During the quarter, the Federal Open Market Committee raised the federal funds target rate range two times to a target range of 4.75-5.00%. They have increased rates nine times since March of 2022 and have shifted their language to indicate that an end to hikes is coming. Inflation remains above their 2% target but is slowing, and the labor market, while posting a still-solid 236,000 jobs created in March, is similarly cooling.

Three-year and five-year inflation expectations are about 2.3%, indicating a market belief that the inflation bogeyman is retreating back under the bed.

The 10-year U.S. Treasury bond ended the year at 3.49%, decreasing slightly from the beginning of the year. Crude oil ended the quarter at just over $75/bbl. Still, the action in early April from OPEC+ members to cut production by 1 million barrels/day will likely lead to an unwelcome climb in gasoline prices as the summer driving season approaches. Gold, benefiting from the weaker dollar, gained over 8%, ending at $1,987 per ounce.