Two-thirds through the first quarter, it’s a perplexing economic and financial market picture. Reading economic and market tea leaves is always part science and part art, but as data is rolling in this year, a surprising amount is contradictory and not aligning neatly. Much like a powerful tide interacting with a wind from the opposite direction, significant opposing forces are creating choppy waves and tricky cross-currents – meaning uncertainty and volatility. So, we offer some observations.

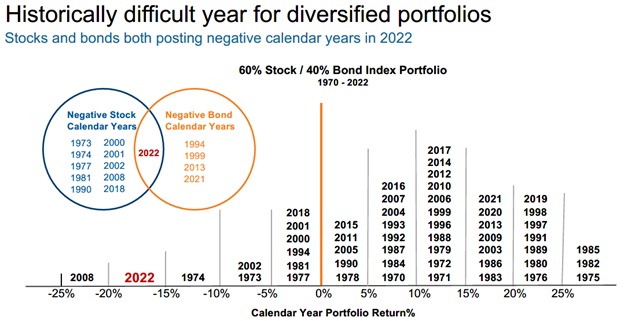

To start, a reminder that 2022 was an unusually tough year. As the chart below shows, negative years for both U.S stocks and bonds is a rarity. In fact, since 1970, that has happened only once … 2022. Couple that with the fact that bonds had their worst year on record, and it might seem logical that – all else held equal – a rebound would be in order. And indeed, 2023 jumped strongly out of the starting blocks. But, as Yogi Berra famously noted, “the future ain’t what it used to be”, and markets have given up some of those early gains.

Let’s look at some of the data. On the positive side of the ledger, the labor market is strong – 517,000 new jobs were created in January – and unemployment sits at 3.4%, the lowest level since 1969. There are two job openings for every job seeker. Not surprisingly that has supported strong consumer data. Retail sales jumped 3% in January, and consumer spending rose 1.8%, the best number since March of 2021. Gross domestic product output (GDP) for the 4th quarter of 2022 came in at a positive 2.7% annualized rate, and analysts are now raising forecasts for the current quarter. Social security recipients have seen an 8.7% increase in payments – a real boost to many who quickly spend those dollars on goods and services. And, in defiance of higher mortgage rates, pending home sales jumped in January as well. While the real estate market has clearly been impacted by mortgage rates above 6%, this data points to pent up demand for homes and rentals that cannot be stifled for long. Looking beyond the US, China has moved away from their Zero-Covid policies, creating optimism that pent up demand will trigger growth in both China and the many economies that are impacted by their status. And economies in most developed markets have likewise surprised doubters by posting better-than-expected economic momentum. All of this translate back to the US and an economy that, as 2022 ended and 2023 began, was moving ahead. As the chief economist for KPMG, Diane Swonk, noted, “It’s still a rolling boil of an economy …” Of course, stock markets like economic growth, and this data has been fuel for the bulls.

Contrast those figures with various forward-looking measures which are far less optimistic. The well-respected and non-partisan Conference Board Leading Economic Index declined 0.3% in January following a drop of 0.8% in December, and noted they expect “… high inflation, rising rates, and contracting consumer spending to tip the U.S. economy into recession in 2023.” The ISM manufacturing Purchasing Managers Index (PMI) fell to its lowest since May of 2020. 90% of S&P market cap companies have reported their fourth quarter earnings and compared to a year ago those profits fell by 13%. Importantly, profit margins also fell to 10.8%, a decline of nearly 20% from the same time last year. Large retailers such as Wal-Mart, Home Depot, and Target have all recently issued warnings of slower demand, and major technology companies have announced significant layoffs.

But the lurking elephant in the room of worries is interest rates and inflation. The era of low (and even negative) interest rates accompanied by seemingly never-ending governmental fiscal stimulus is decidedly in the rearview mirror. Instead, we are facing coordinated hiking by central banks around the world, persistent inflationary pressures, and an unwinding of the extraordinary stimulus measures. In the US, the Fed’s balance sheet is shrinking by approximately $95 billion a month. Fed officials are once again jawboning about the possibility of 50 basis point hikes at their upcoming March meeting, and expectations of their peak rate target in 2023 is now 5.2% (current target is 4.50% – 4.75%). The yield curve is inverted – meaning short interest rates are higher than long – a traditionally accurate predictor of recession within the next 12 months. Household excess savings that ballooned during the pandemic have shrunk back to 2005 levels, car loan delinquencies are on the rise, and credit card debt is growing. Oh, and did anyone mention the debt ceiling? The acrimonious debate around raising the US debt limit is sure to rise in volume as we approach the summer and a Treasury faced with being unable to pay its bills. While the ceiling has been raised every single time in history, the process in recent years is surrounded with posturing on all sides and much negative news. And finally, top off the cake with the one-year anniversary of Russia’s invasion of Ukraine, and the negative impact that continues to have on global economic, energy, and sovereign security. The world remains a dangerous place.

So, who is right? Bulls who see stocks and economies powering on, or bears who see recession on the horizon? Or perhaps the hot new description, a “rolling recession” where, at different times, various sectors of the economy falter, and then recover. Unfortunately, as we have said many times before, no one has the perfect crystal ball. To borrow a phrase from our friends at Dimensional Funds Advisors, “Focus on what you know, not what you think.” What we do know is that the declines in bond and stock prices in 2022 have made assets more reasonably priced. The Fed is much closer to an end of the current hiking cycle than the beginning, and companies are actively reducing inventory and adjusting operations to support profit margins. It’s critical to remember that successful investing is not an all-or-nothing exercise with only perfection or failure. As investors, our biggest allies are discipline, consistence, and patience, and most forecasts that claim certainty wind up missing the mark.

But there are clear themes and trends that do appear and emphasizing those can bear fruit. Today, we are seeing broad consensus around several areas.

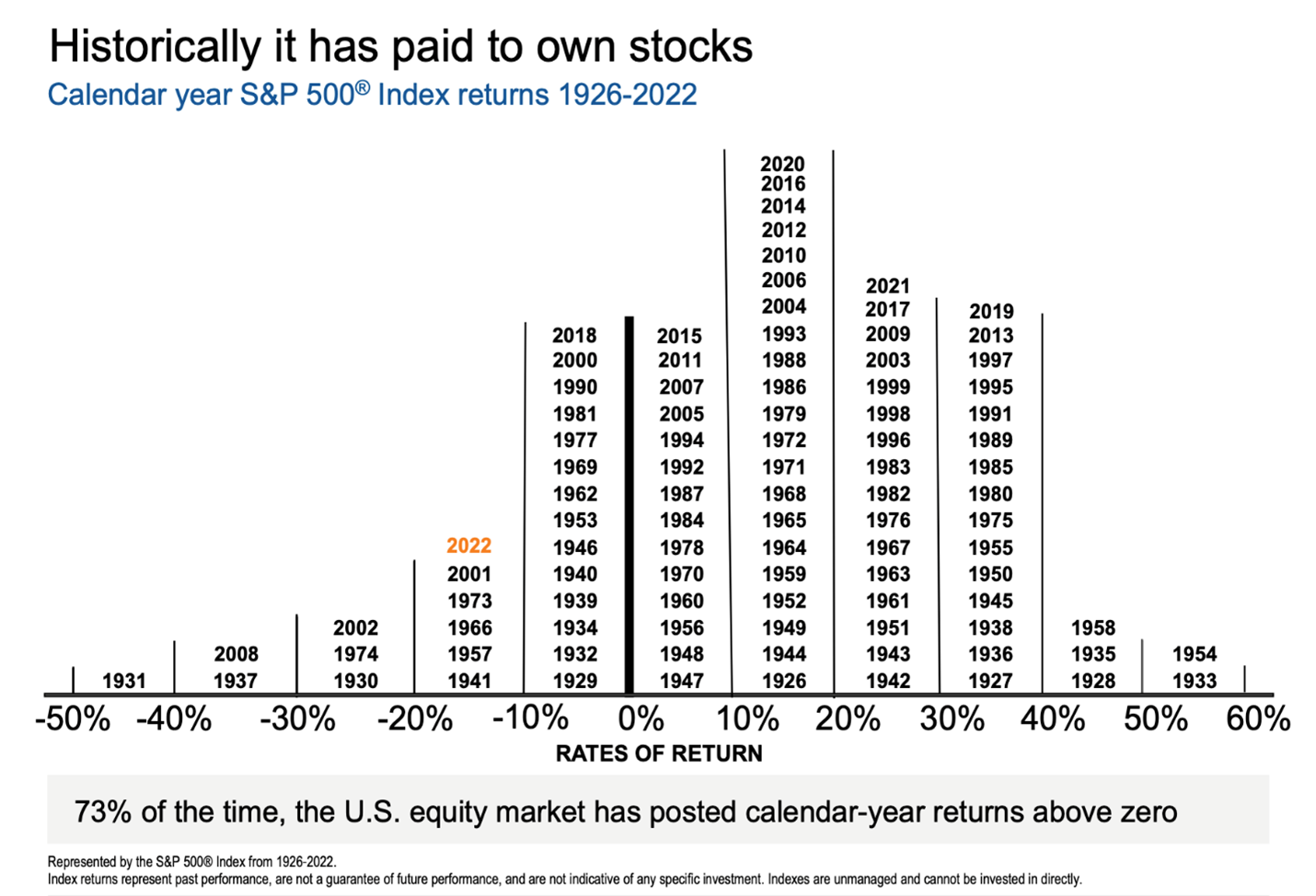

- The chart below is an example of perhaps the most important to remember– it pays to own stocks! This can be easy to forget when markets are falling or in the doldrums, but history is clear – stocks rise in value far more often than they fall. Being scared away from equity markets after they fall ensures missing out of the subsequent rebound. Since 1926, the S&P 500 has provided a positive return 73% of the time – a clear winner for those with staying power.

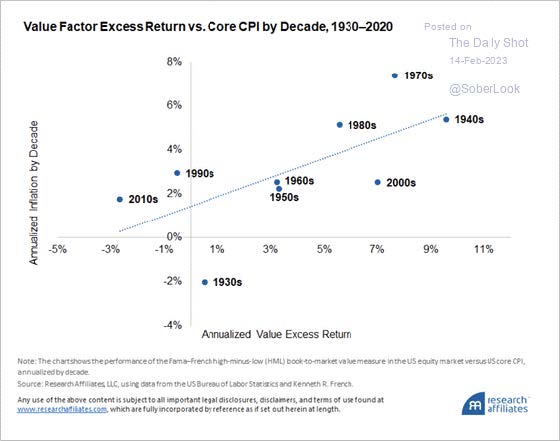

- Secondly, not all stocks are created equal. JFS portfolios, while broadly diversified, “tilt” toward a value emphasis. The reasoning behind that tilt is backed up by evidence – since 1926 the returns on value stocks have exceeded those on growth stocks by 4% per year on average, a huge cumulative benefit. While the cycles vary and growth also has periods of outperformance, those tend to be episodic and followed by significant declines (growth stocks fell about 30%) in 2022, while value fell about 7%). The long view is clearly in favor of a value style. The economic environment matters as well — higher interest rates and persistent inflation favor value. As shown below, a recent study from Research Affiliates demonstrates that the value benefit increases during times of inflationary pressure — arguably the more recent secular shift we are seeing presently underway.

- Third, bonds are attractive at these levels and should resume their traditional role as an income generator and non-correlated portfolio ballast. While rates well may climb further before peaking, last year’s historic moves in the bond market mean that much of the price adjustment is already factored in, and current yields on high quality bonds of between 5% and 6% – with an expectation that inflation will continue to decline from these levels – mean bonds should be on the radar screen. Not only does the current yield provide an income cushion to portfolios, don’t forget that bond price will rise as the Fed cycle ends and downshifts to neutral or even cutting rates. And while bonds and stocks moved in tandem last year, that is unusual – traditionally bonds supply important non-correlation, smoothing the portfolio ride. Ensuring portfolios are rebalanced back to bond targets is important.

- Lastly, international and emerging market stocks should hold a healthy portfolio weight. While there is no single target that fits all, JP Morgan recently noted that they consider 35% of stocks targeted to international to be a “neutral” weight. The reasons? The current MSCI AC World ex-US index P/E ratio is 12.8, below its 20-year average of 13.1, and the S&P 500 P/E is 18, above its 20-year average of 15.5. In addition, when considering future earnings, the international index trades at nearly two standard deviations under its historical forward P/E relationship to the US. International and US stocks typically trade leadership over expended period of times, and the recent cycle has benefited the US, suggesting the next cycle will be favorable to international. Add in the re-opening of China, and a US dollar that by most measures is hovering near peak levels, and the stage is set for international investing to provide a significant portfolio tailwind.

It’s easy to talk about portfolio positives and negatives in the abstract, far harder to remain objective in the face of volatility. We understand the angst that economic volatility and uncertainty can cause and encourage you to reach out to your JFS team with questions or concerns. They know your situation, have plans for meeting your long-term goals, and can make certain your goals and aims are aligned with the proper portfolio allocation. Our firm is centered around one thing – helping you thoughtfully and carefully plan for and meet your goals. It is our privilege to walk with you on that path.