The Tax Cuts and Jobs Act (the Act) that was signed into law at the end of 2017 makes significant changes to the U.S. Tax Code as we know it and affects virtually every taxpayer—individual taxpayers in particular. While there are some changes in the new legislation that could impact your 2017 tax return, it is important to understand how the new law will shape your tax situation and related tax planning opportunities.

With the reduction in effective tax rates, the elimination of some deductions, exclusions and credits coupled with the enhancement of other deductions and credits, individual taxpayers will need to navigate a different maze in making decisions to maximize their tax benefits and minimize their tax liability.

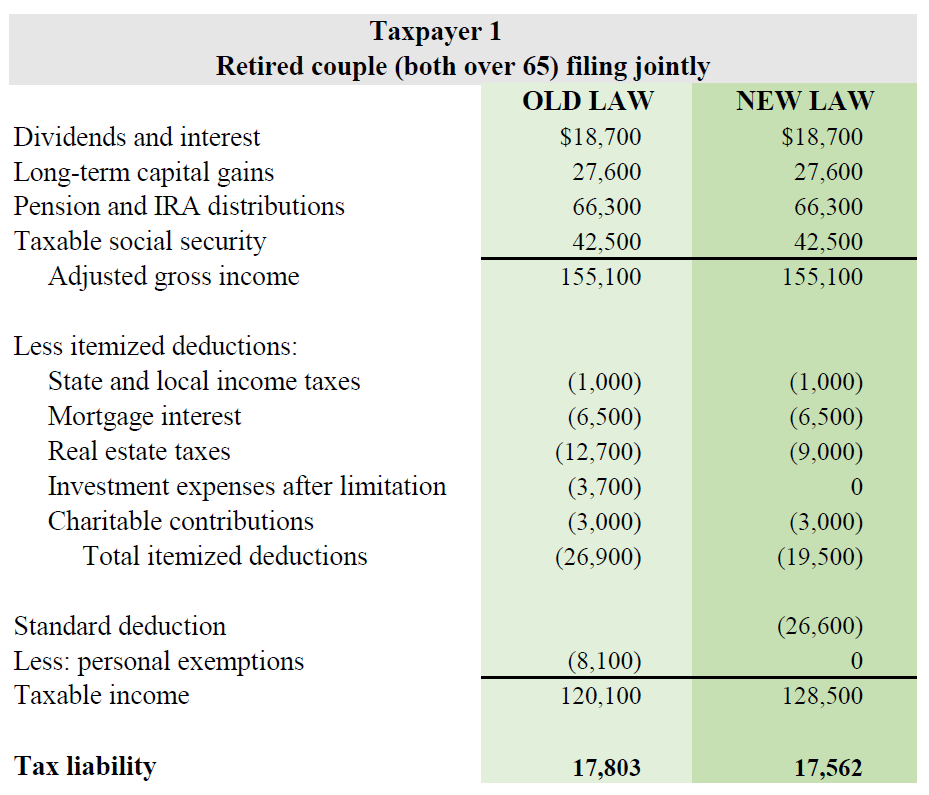

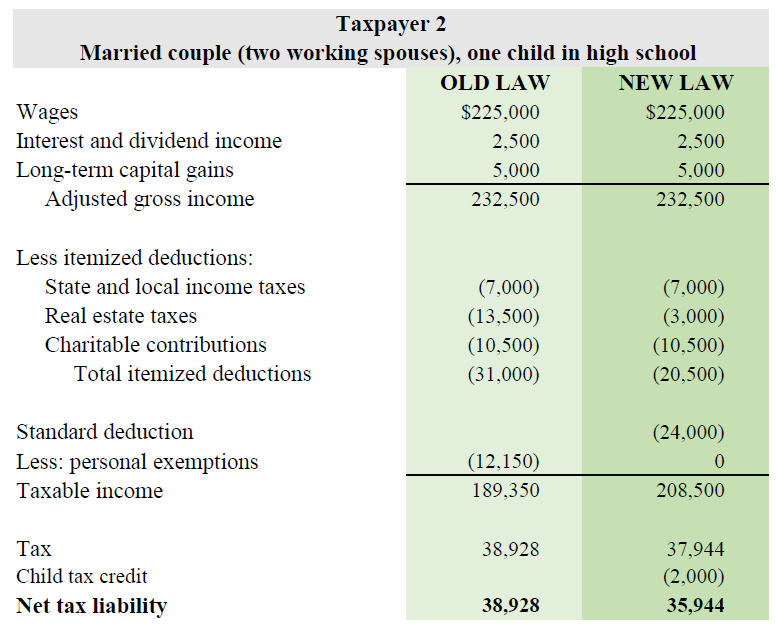

A provision of the Act that affects all individuals is the elimination of the deduction for personal exemptions and the near doubling of the standard deduction. The higher standard deduction that replaces the personal exemption, along with the loss or limitation of certain itemized deductions, will channel an even greater number of taxpayers to the standard deduction.

The Act significantly changes itemized deductions for tax years 2018 through 2025. Some of the changes include:

- Miscellaneous itemized deductions subject to the 2 percent floor, including unreimbursed employee business expenses, tax preparation fees and investment advisory fees, are suspended.

- Annual itemized deductions for all state and local taxes, including property taxes, is capped at $10,000.

- The itemized deduction for home mortgage interest is limited to interest paid or accrued on acquisition debt and the deduction for interest on home equity debt is suspended. The maximum amount that may be treated as acquisition debt is also reduced to $750,000 ($375,000 if married filing separately) for any acquisition debt incurred after December 15, 2017. It remains $1,000,000 for acquisition debt incurred before January 1, 2018.

- The threshold for medical expense deductions is lowered to 7.5 percent of adjusted gross income (AGI) for tax years 2017 and 2018, and casualty losses will only be allowed for losses in federally declared disaster areas.

With these changes, a large number of taxpayers will no longer have itemized deductions that exceed the standard deduction.

An enhanced child and family tax credit will make up some of the difference for certain families. As a credit, in contrast to a deduction, the enhanced child credit has been highlighted as one of the provisions that will lower overall tax liability for many middle-class families.

In addition to these provisions, there are several other changes that will impact individuals, which will be covered in future communications. The tax law changes are further complicated by the fact that many of the changes are temporary, generally ending after 2025. Therefore, a comprehensive tax plan must be flexible and anticipate either expiration of these changes or possible extenders in years to come.

The following are two example scenarios of how new legislation affects individual taxpayers:

Keep an eye out for more from us in coming weeks as we dig deeper in our Tax Reform 2018 Series. If you are unclear about how any of these changes affect your personal situation, please don’t hesitate to contact a member of your service team.

As Tax and Accounting Manager for JFS Wealth Advisors, Michelle Wright, CPA, MST, is responsible for managing individual income tax compliance and business accounting services, developing and implementing tax planning strategies and assessing the impact of tax law changes for individuals and businesses. If you have questions regarding this or other tax-related topics, contact Michelle at mwright@jfswa.com.