Menu

Close

- Services

EXPLORE OUR SERVICE OFFERINGS

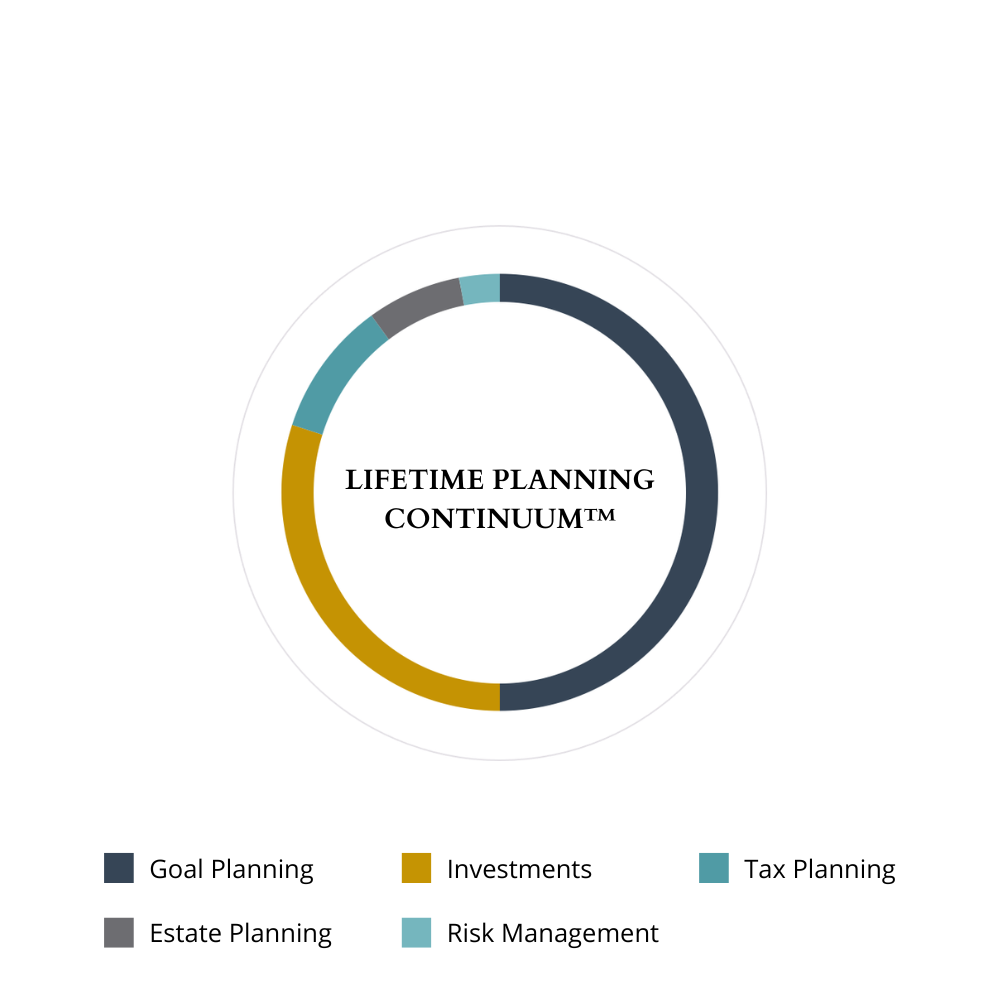

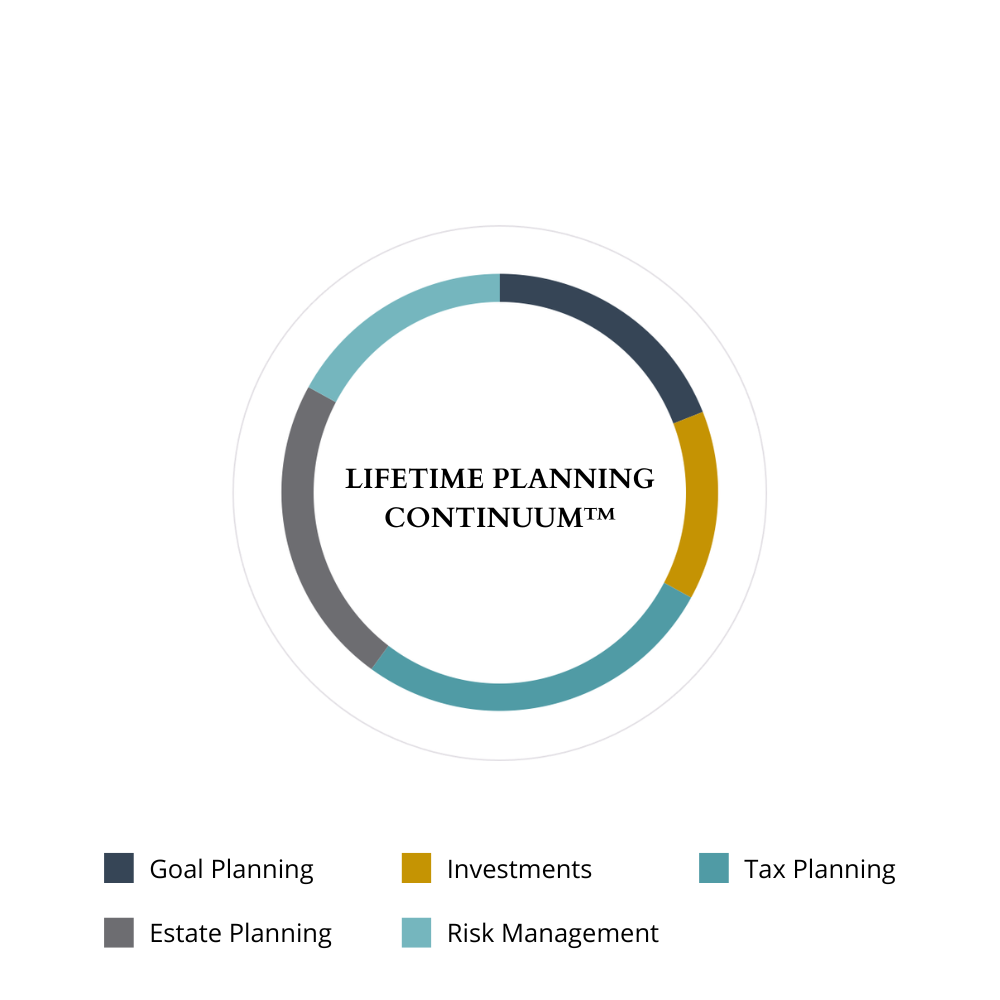

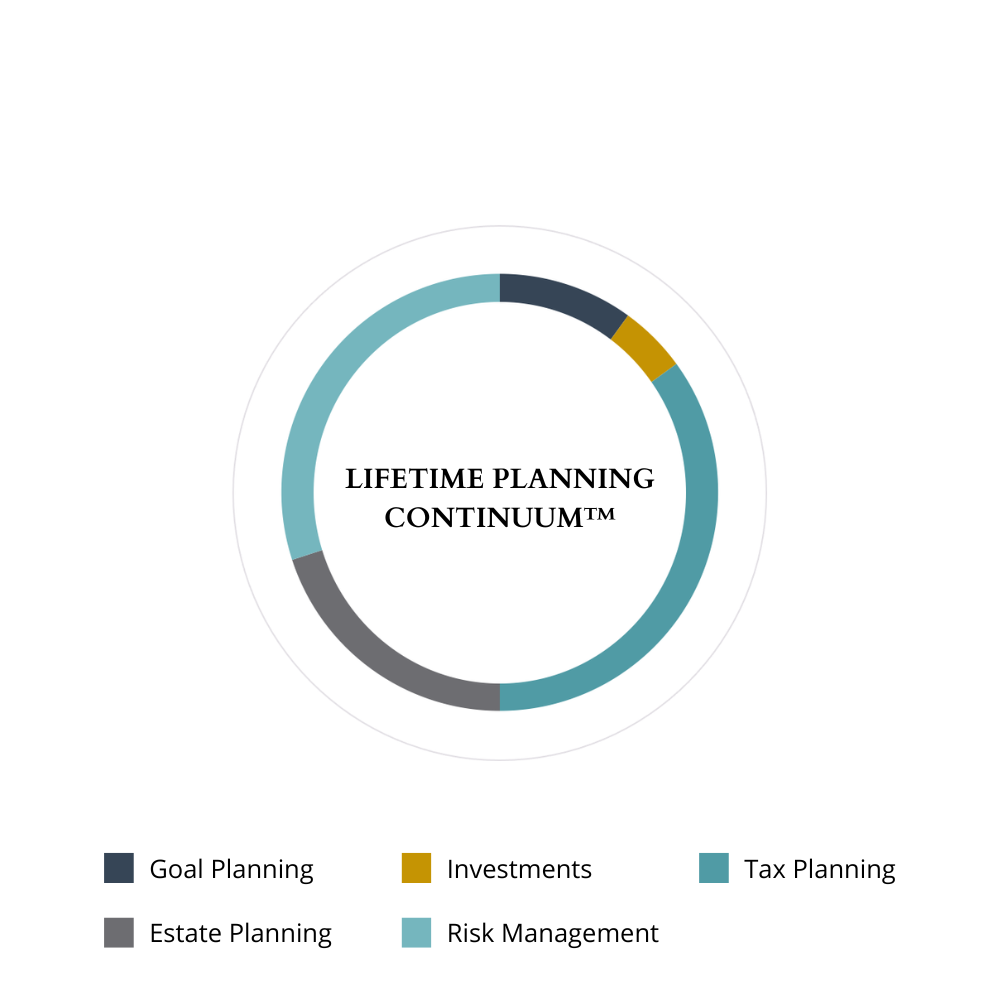

Whether you’re building wealth, strengthening and preserving wealth, or entering the golden years of retirement, our holistic wealth management services can help you navigate every stage of life.From understanding what your business is worth to setting up employee benefits to selling and the tax compliance that follows, we offer dedicated support for companies of all sizes. - About

- Client Experience

- Locations

EXPLORE OUR OFFICE LOCATIONS

- Resources

WEBINARS

Gifting & Estate Planning Strategies

September 18, 2025

Preparing for Tax Policy Changes on the Horizon

June 17, 2025

- Contact

- Services

EXPLORE OUR SERVICE OFFERINGS

Whether you’re building wealth, strengthening and preserving wealth, or entering the golden years of retirement, our holistic wealth management services can help you navigate every stage of life.From understanding what your business is worth to setting up employee benefits to selling and the tax compliance that follows, we offer dedicated support for companies of all sizes. - About

- Client Experience

- Locations

EXPLORE OUR OFFICE LOCATIONS

- Resources

WEBINARS

Gifting & Estate Planning Strategies

September 18, 2025

Preparing for Tax Policy Changes on the Horizon

June 17, 2025

- Contact